“IWMY Stock: The Ultimate 0DTE ETF for High-Yield Returns”

What is IWMY?

IWMY stock refers to the Defiance R2000 Enhanced Options & 0DTE Income ETF, an exchange-traded fund (ETF) designed to expose small-cap stocks while utilizing zero days to expiration (0DTE) options strategies. This ETF is structured to generate income while managing risk through short-term options trading.

The Purpose and Strategy Behind IWMY

The primary goal of IWMY ETF is to enhance returns by leveraging a sophisticated options-based income strategy. Unlike traditional ETFs that track an index passively, IWMY employs an active management approach, incorporating options contracts that expire on the same day (0DTE) to capture premium income.

Why is IWMY Gaining Popularity?

IWMY is gaining traction due to its unique income-generating strategy and enhanced volatility management. Investors are particularly drawn to its:

- High yield potential due to frequent option premium collections.

- Exposure to small-cap stocks, providing diversified growth opportunities.

- Risk management through options strategies, reducing downside exposure compared to traditional ETFs.

IWMY ETF – Key Features and Investment Strategy

How IWMY Works – A Step-by-Step Breakdown

- Tracks the Russell 2000 Index: Provides exposure to small-cap stocks.

- Incorporates 0DTE options strategies: Uses same-day expiration options to generate premium income.

- Actively managed approach: Professional fund managers adjust positions dynamically to optimize returns.

What Makes IWMY Unique?

- First-of-its-kind 0DTE ETF, differentiating it from conventional funds.

- Income-focused approach, appealing to yield-seeking investors.

- Enhanced risk mitigation, reducing exposure to prolonged market downturns.

0DTE (Zero Days to Expiration) Options Strategy Explained

The 0DTE options strategy involves trading options that expire on the same day, allowing traders to capture premium income while minimizing overnight risk. This approach is beneficial in volatile market conditions, providing a hedge against sudden price swings.

IWMY ETF Performance and Historical Data

Recent Price Movements and Trends

IWMY stock has shown steady growth, with price fluctuations influenced by market volatility, economic conditions, and investor sentiment. Key factors affecting performance include:

- Interest rate changes impacting small-cap stocks.

- Market sentiment towards options-based ETFs.

- Liquidity and trading volume trends.

Historical Performance Over Time

Since its inception, IWMY has exhibited a strong return profile, outperforming many traditional small-cap ETFs. Historical data indicates consistent premium income generation, making it a preferred choice for risk-averse investors.

Key Volatility Metrics and Market Impact

- Beta: Measures volatility compared to the broader market.

- Implied Volatility (IV): Indicates expected price movements.

- Historical Volatility (HV): Assesses past price fluctuations.

Financials and Dividend Information

Net Asset Value (NAV) and Expense Ratio

- NAV: Represents the per-share value of the ETF’s holdings.

- Expense Ratio: Currently set at 1.02%, covering operational costs.

Dividend Yield and Distribution

IWMY provides attractive dividend yields due to its options premium income, making it a compelling choice for income-focused investors.

Ex-Dividend Date and Payout History

Investors should track the ex-dividend date to qualify for payouts. The ETF follows a structured distribution schedule, ensuring regular income for shareholders.

Risks and Challenges of Investing in IWMY

Market Volatility and 0DTE Options Risks

- High volatility: Small-cap stocks are inherently more volatile.

- Options market fluctuations: 0DTE strategies can be unpredictable.

- Risk of rapid losses: Short-term options may lead to sudden drawdowns.

Liquidity and Trading Considerations

- Lower trading volume compared to larger ETFs.

- Potential bid-ask spread concerns impacting entry/exit strategies.

- Market conditions influencing liquidity fluctuations.

Expense Ratio and Management Fees

IWMY’s 1.02% expense ratio is relatively high compared to passive ETFs, justified by its active management and options strategies.

If you want to read more informative contents please visit: Spzi-stock

How to Invest in IWMY ETF?

Where to Buy IWMY – Best Platforms and Brokers

- Online brokerage platforms like Webull, TD Ameritrade, and Fidelity.

- ETF-focused investment firms provide access to specialized funds.

- Financial advisors for guided investment strategies.

Factors to Consider Before Investing

- Risk tolerance: Understand the volatility and strategy.

- Investment horizon: Long-term vs. short-term goals.

- Portfolio diversification: How IWMY fits within overall holdings.

Who Should Invest in IWMY?

- Income-focused investors seeking dividend-generating ETFs.

- Options traders looking for exposure to 0DTE strategies.

- Risk-managed investors are interested in small-cap market exposure with hedging capabilities.

Comparisons – IWMY vs. Other ETFs

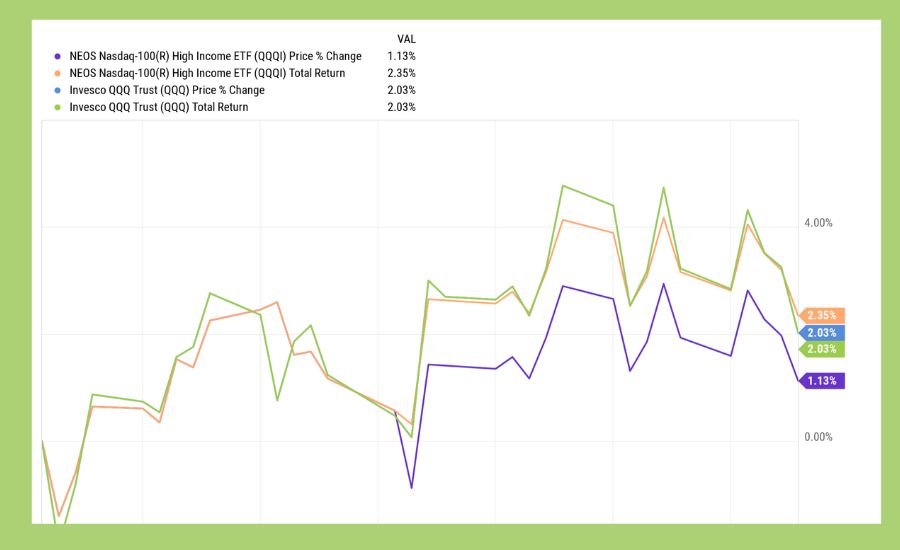

IWMY vs. Traditional ETFs (SPY, IWM, QQQ, etc.)

- IWMY: Actively managed, options-driven income strategy.

- SPY/IWM/QQQ: Passive tracking, dependent on market movements.

- Higher yield potential with IWMY, but also greater complexity.

How IWMY Stands Against Other 0DTE ETFs

- Unique in its approach, leveraging Russell 2000 small-cap exposure.

- More frequent income generation compared to other 0DTE funds.

Pros and Cons Compared to Similar Funds

Pros:

- Higher-income potential through options premiums.

- Active management reduces market exposure risks.

- Enhanced volatility control.

Cons:

- Higher expense ratio.

- Requires investor knowledge of options trading.

Future Outlook for IWMY and 0DTE ETFs

Market Predictions and Growth Potential

- 0DTE strategies are gaining traction among institutional and retail investors.

- Potential for increased liquidity and trading volume in the coming years.

The Evolution of 0DTE Strategies in ETFs

- More ETFs adopting options-based income models.

- Advancements in risk management techniques for sustainable growth.

Expert Opinions on IWMY’s Future

Financial analysts project strong growth potential, with IWMY likely to attract more capital as awareness of 0DTE strategies increases.

Frequently Asked Questions (FAQs)

Q: Is IWMY a Good Investment for 2025?

A: IWMY offers a unique income strategy, making it attractive for risk-aware investors.

Q: How is IWMY Different from Traditional ETFs?

A: Unlike traditional ETFs, IWMY employs active options trading to enhance returns.

Q: What are the Risks of Investing in IWMY?

A: Key risks include market volatility and options-related uncertainties.

Q: How Often Does IWMY Pay Dividends?

A: IWMY pays dividends regularly, based on options premium income.

Q: Can IWMY Be Used for Short-Term Trading?

A: Yes, active traders can leverage their volatility and options strategies.

Q: What is the Expense Ratio of IWMY?

A: The expense ratio is 1.02%, covering management fees and operations.

Q: Where Can I Track the Latest Performance of IWMY?

A: Market data is available on brokerage platforms, financial news sites, and ETF tracking websites.

Conclusion

IWMY stock is a unique ETF that uses 0DTE options to create income while tracking the Russell 2000. It has gained popularity because of its smart strategy, strong dividend yield, and growth potential. However, investors should always consider risks like market volatility, liquidity, and management fees before investing.

If you want to invest in IWMY, research, compare it with other ETFs, and choose the right platform. Whether you are looking for short-term trading or long-term growth, IWMY can be a good option if it fits your financial goals. Always stay updated with market trends and make smart investment decisions!

Post Comment