alpha Tech Corp. (aire stock) – A Complete Overview

AIRE Stock – Is It a Smart Investment Choice?

AIRE stock represents reAlpha Tech Corp., a technology-driven real estate investment company that leverages AI to identify and manage short-term rental properties. With a unique fractional ownership model, reAlpha allows investors to earn passive income from high-value rental properties without direct management.

The Business Model of Alpha

reAlpha operates on a unique model that combines technology with real estate investment. The company identifies profitable rental properties, acquires them, and then lists them on platforms like Airbnb and Vrbo. Investors can purchase shares in these properties, earning passive income without the hassle of direct property management. This model lowers the barrier to entry for real estate investment, making it accessible to a broader range of investors.

Key Features and Offerings of Alpha

- AI-Powered Property Selection: reAlpha uses proprietary algorithms to identify high-potential short-term rental properties.

- Fractional Ownership: Investors can buy shares in real estate assets, diversifying their portfolios without purchasing entire properties.

- Automated Property Management: The company handles property maintenance, bookings, and revenue optimization.

- Blockchain Integration: reAlpha explores blockchain technology to enhance transparency and security in property transactions.

Financial Performance and Stock Analysis

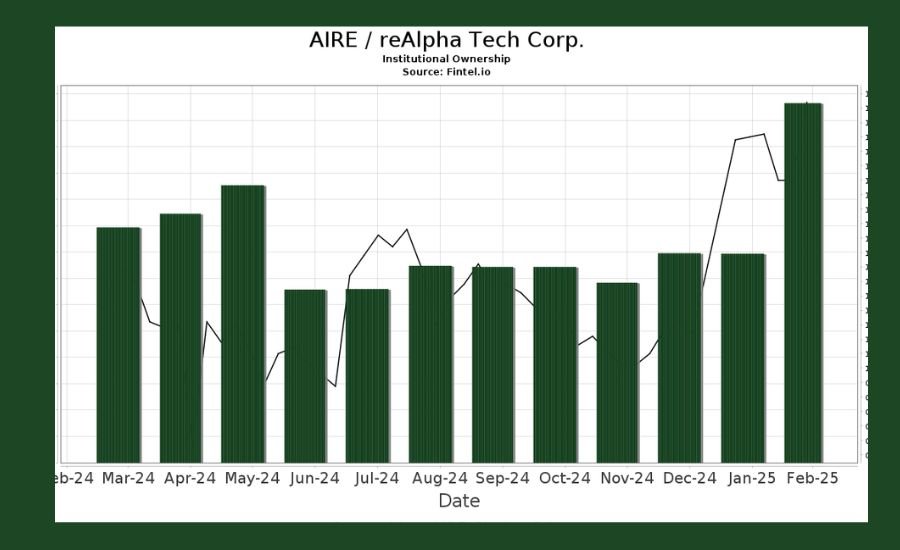

AIRE Stock Price and Market Performance

AIRE stock has experienced fluctuations, reflecting market conditions and company performance. As of recent data, the stock has traded within a 52-week range of $0.53 – $4.49, showing volatility common in emerging tech-driven businesses. Investors closely monitor its market trends to assess its potential for long-term growth.

Key Financial Metrics and Revenue Breakdown

reAlpha’s revenue model is based on property acquisitions, rental income, and investor contributions. The company reports revenue from its short-term rental portfolio while continuously expanding its asset base. Key financial metrics include:

- Revenue Growth Rate

- Earnings Per Share (EPS)

- Profit Margins

- Debt-to-Equity Ratio

Recent Earnings Reports and Growth Trends

Recent earnings reports indicate steady growth, with reAlpha expanding its property portfolio and improving operational efficiency. Analysts consider factors such as revenue increases, property acquisitions, and investor sentiment to protect the company’s future performance.

Competitive Landscape – Who Competes with reAlpha?

Major Competitors in the Real Estate Tech Industry

Alpha competes with various real estate investment platforms and tech-driven property management firms, including:

- Fundraise

- Roofstock

- Airbnb (in terms of rental management technology)

- Pacaso

How reAlpha Stands Out from Competitors

- AI Integration: Advanced machine learning algorithms for property selection.

- Fractional Ownership Model: Lower investment threshold compared to traditional real estate investing.

- Focus on Short-Term Rentals: Unlike competitors, reAlpha specializes in high-yield vacation rental properties.

Market Share Comparison and Industry Positioning

reAlpha is positioning itself as a leader in tech-enabled real estate investment. While still growing its market share, its AI-driven approach gives it a competitive edge.

Investment Opportunities with alpha

Why Investors Are Interested in AIRE Stock

Investors see potential in reAlpha due to:

- Tech-Driven Strategy

- Growing Short-Term Rental Market

- Potential for High Returns

Risks and Challenges in Investing in Alpha

- Stock Price Volatility

- Regulatory Challenges in Short-Term Rentals

- Market Competition

Future Projections and Growth Potential

Analysts predict continued growth for reAlpha as it expands its property portfolio and refines its technology. AI and blockchain integration may further enhance its market position.

Technology and Innovation in Alpha

How AI is Transforming Real Estate Investment

AI helps investors make data-driven decisions by analyzing property values, rental demand, and pricing trends.

reAlpha’s Proprietary Technology and AI Tools

The company utilizes predictive analytics to assess property profitability, helping investors maximize returns.

Role of Data Analytics in reAlpha’s Success

By leveraging big data, reAlpha can identify market trends, optimize pricing strategies, and enhance property management efficiency.

If you want to read more informative contents please visit: 5starsstocks-com-defense

Business Model and Revenue Streams

How reAlpha Generates Revenue

- Rental Income from Short-Term Properties

- Investor Contributions

- Property Appreciation

Partnership and Expansion Strategies

reAlpha collaborates with real estate firms, tech partners, and investment funds to scale operations.

Real Estate Investment and Rental Market Trends

The short-term rental market is expected to grow, driven by travel demand and digital transformation.

Recent Developments and Strategic Moves

Acquisitions and Mergers Involving alpha

The company explores acquisitions to expand its property holdings and enhance its technological capabilities.

reAlpha’s Expansion into New Markets

reAlpha is targeting new geographic locations with high rental potential.

New Features and Platform Updates

The company continues to develop innovative tools to improve investor experience and property management efficiency.

Future of reAlpha and Industry Trends

Predictions for reAlpha in the Next 5 Years

Analysts anticipate:

- Increased Investor Participation

- Further AI Integration

- Expansion into Global Markets

Emerging Trends in Real Estate Technology

The adoption of AI, blockchain, and smart contracts is reshaping the real estate investment landscape.

How AI and Blockchain Might Impact reAlpha’s Business

Blockchain can enhance transparency, while AI-driven automation improves operational efficiency.

Frequently Asked Questions (FAQs)

Is reAlpha Tech Corp. a Good Investment?

Investors should consider reAlpha’s growth potential, market trends, and risk factors before investing.

What Makes reAlpha Different from Other Real Estate Investment Platforms?

Its AI-powered property selection and fractional ownership model set it apart.

What Are the Risks Associated with reAlpha’s Business Model?

Regulatory challenges, market volatility, and competition are key risks.

How Can I Buy AIRE Stock?

AIRE stock is available on NASDAQ and can be purchased through brokerage accounts.

Where Can I Track reAlpha’s Stock Performance?

Investors can track AIRE stock performance through financial news platforms, stock market apps, and brokerage websites.

Conclusion

reAlpha Tech Corp. is changing real estate investment with smart technology and AI. It makes it easier for people to invest in rental properties without owning them fully. With its unique business model, strong growth potential, and AI-driven tools, reAlpha is attracting investors who want to be part of the booming short-term rental market. AIRE stock is an exciting opportunity, but like any investment, it comes with risks, such as stock price changes and market competition.

As reAlpha grows, it plans to expand into new markets and improve its technology. AI and blockchain could make real estate investing even more efficient in the future. Investors should keep an eye on AIRE stock, stay updated with market trends, and consider both the rewards and risks before making a decision. Whether you’re a beginner or an experienced investor, reAlpha offers an innovative way to enter the world of real estate investing.

Post Comment